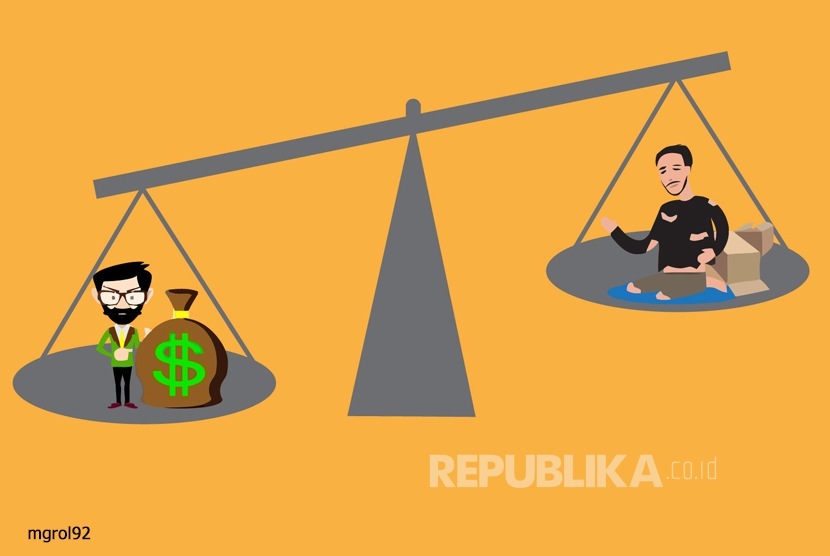

Fintech Association Reveals Efforts to Bail Investree Were Made Prior to Permit Repeal by OJK

Fintech Association reveals that efforts to rescue Investree were made before its operating license was revoked by OJK.

TEMPO.CO, Jakarta - Entjik S. Djafar, chairman of the Indonesian Lending Companies Association (AFPI), revealed that efforts to rescue company PT Investree Radika Jaya were made before its operating license was revoked by the Financial Services Authority (OJK). Investree is now waiting for the formation of a liquidation team.

Entjik said that Investree had been considered for help from the association. AFPI, he mentioned, had discussed with OJK and formed a group consisting of large fintech companies to help save other fintech companies facing non-performing loans or issues.

In November last year, OJK noted that 21 fintech lending companies were found to have problematic loan levels or TWP90 (90-day default rate) of more than the safe threshold of 5 percent. Most of them were operators focusing on the productive sector.

"Specifically for , before the license was revoked, we had discussions. We planned to get involved in rescuing it,” he said in West Bandung, West Java, Wednesday, January 22.

However, due to certain circumstances, Entjik said, the companies backed out, and Investree was not saved. "In the end, it didn’t happen, and its license was revoked by OJK," he stated. Entjik did not provide further details on the association's reasoning when deciding not to rescue Investree.

Meanwhile, OJK has given the green light for the formation of a liquidation team for PT Investree Radika Jaya (PT IRJ). OJK's chief executive for the supervision of financing institutions, venture capital companies, microfinance institutions, and other financial services institutions, Agusman, said that OJK had no objections to the formation of the liquidation team.

Agusman added that OJK had also reviewed the suitability of three candidates for the Investree liquidation team. "Next, Investree will be required to hold a general meeting of shareholders to decide on the dissolution and formation of the liquidation team," Agusman said in a press statement, Friday, January 10.

OJK revoked Investree’s operating license due to violations of minimum equity and other regulations on October 21, 2024. According to OJK Regulation No. 10/POJK.05/2022 on Technology-Based Crowdfunding Services (LPBBTI), another reason for Investree’s permit loss was its deteriorating performance, which disrupted its operations and services to the public.

From 2015 to 2024, Investree distributed loans to 93,769 borrowers, both individuals and institutions. Investree also disbursed Rp14.43 trillion, with Rp13.36 trillion in repaid loans. There is still an outstanding loan amount of Rp402.13 billion.

Before the company’s operating license revocation, Investree CEO Adrian Gunadi was dismissed on February 2, 2024, amid the company’s high non-performing loan rates. According to Investree’s official website at the time, the company’s TKB90 (success rate) was 83.56 percent.

Editor's Choice:

to get the latest news updates from Tempo on Google News